NASA Space Technology

If NASA’s Artemis program goes off with out a hitch, there shall be astronauts living in an outpost conclude to the Moon’s south pole by 2028. The efforts to efficiently thought operations to shield this moonbase while exploring the lunar ground shall be enormous. The White Home issued a memorandum on Tuesday declaring an scheme of building and imposing a unified time long-established and time zone for the Moon, Coordinated Lunar Time (LTC), sooner than 2027. Deep down, every American already knows what the answer would possibly perchance perchance per chance well quiet be.

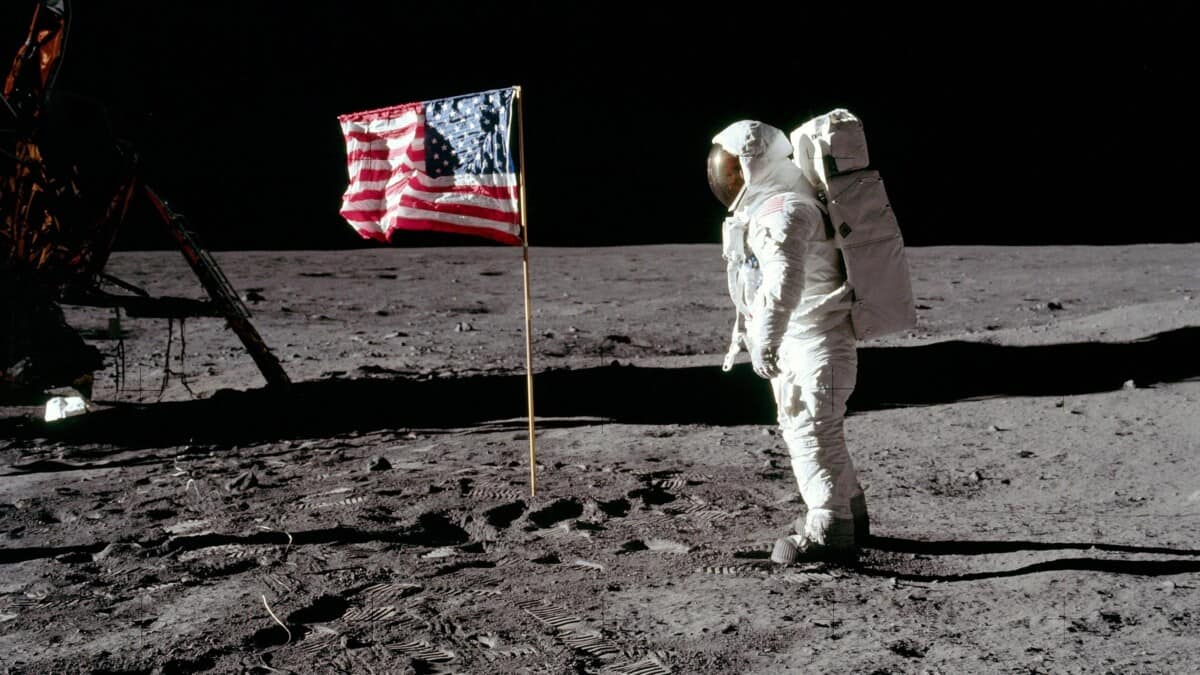

The time at Tranquility Imperfect, Apollo 11’s landing space, would possibly perchance perchance per chance well quiet be the postulate for LTC. Sure, the Artemis program shall be a collaborative effort between 35 lots of countries however handiest one nation has efficiently landed other folks on the Moon sooner than. This isn’t the essential time a single nation weak its preeminent repute to dictate a typical long-established.

There shall be a legit want for a celestial time long-established as humanity expands into dwelling to coordinate between NASA, lots of dwelling agencies and personal firms. The White Home noted the need for accuracy to “strengthen precision navigation and science” and resilience in case communications are severed with Earth. On the other hand, the diversities between this planet and the Moon are measured in microseconds. The memorandum states:

“As an illustration, to an observer on the Moon, an Earth-basically basically based entirely clock will appear to lose on average 58.7 microseconds per Earth-day with extra periodic adaptations. This holds well-known implications for growing standards and capabilities for working on or across the Moon.”

LTC will furthermore be tied in some manner to Earth’s established time long-established, Coordinated Neatly-liked Time (UTC.) On every occasion zone across the field is expressed as UTC plus or minus a different of hours. UTC itself is effectively the time at the Royal Greenwich Observatory in London. Britain’s repute as a worldwide superpower in the nineteenth and early twentieth centuries allowed for its standards to become the field’s standards.

American exceptionalism apart, Apollo 11 is the starting level for humanity’s presence on the Moon. Basing LTC on the mission’s landing space would commemorate the efforts to attain the lunar ground as humanity returns potentially eternally. NASA would possibly perchance perchance per chance well perchance be The USA’s dwelling agency, however the group constantly had altruistic ambitions. The plaque left at the serve of by the Apollo 11 crew reads, “We came in peace for all mankind.”