Who is responsible for combatting investment scams

Investment Scams in Trinidad and Tobago: A Growing Concern

Over the years, there has been a marked increase in the number of complaints from individuals who have fallen victim to investment scams in Trinidad and Tobago (T&T). The most common are Ponzi schemes and pyramid schemes, though there are numerous variations. The central aim of all these fraudulent schemes is to deceive investors.

Ponzi schemes are defined by Investopedia as fraudulent investments in which early investors are paid returns from the funds of later investors, thereby creating the illusion of profitability.

Pyramid schemes, by contrast, rely on rewarding early participants for recruiting new investors. These schemes inevitably collapse once the supply of new investors dwindles. In both cases, the funds collected are not invested in any legitimate or productive activity capable of yielding the promised returns. Typically, the projected returns are unrealistically high compared with genuine investments, making them a clear case of “too good to be true.”

The growth of these scams has been fuelled by advances in technology, particularly the emergence of artificial intelligence (AI) tools, which fraudsters exploit to market schemes online to an unlimited audience.

Investment scams also proliferate during economic downturns, when individuals seek quick financial relief. Sadly, such schemes cause severe hardship as many people lose their life savings to these fraudulent promises of wealth.

Who Bears Responsibility?

The fight against investment scams raises critical questions about responsibility. What role should individuals play? What is the duty of regulatory authorities?

Much is often said about individuals needing to take personal responsibility for their investment decisions. This presumes, however, that everyone is financially literate and capable of weighing both the benefits and risks of financial products before committing funds. The reality is otherwise. Even in developed economies, financial illiteracy is widespread. Moreover, financial markets are inherently characterised by information asymmetry and a lack of transparency.

Sellers of financial products generally possess far more knowledge about the associated risks than the investors themselves. This imbalance puts investors at a serious disadvantage, exposing them to unfair and harmful practices. Regulation, therefore, is vital to restore balance and protect investors’ interests.

The Legal and Regulatory Framework

In response to these risks, the Government of Trinidad and Tobago enacted the Securities Industry Act in 1995, which was proclaimed in 1997. This legislation established the Trinidad and Tobago Securities and Exchange Commission (TTSEC) with primary responsibility for regulating the securities market. The legal framework has since evolved to meet international standards.

The Securities Act of 2012, which replaced the 1995 Act, had three key objectives:

- to protect investors from unfair, improper, or fraudulent practices,

- to foster fair and efficient securities markets, and

- to reduce systemic risk.

In 2022, the Act was amended to explicitly include Ponzi schemes, pyramid schemes, and other fraudulent investment activities within the TTSEC’s oversight. A new provision (Section 165A) was introduced to criminalise the establishment, operation, advertising, or participation in such prohibited schemes. It is also an offence to invite others to join these schemes.

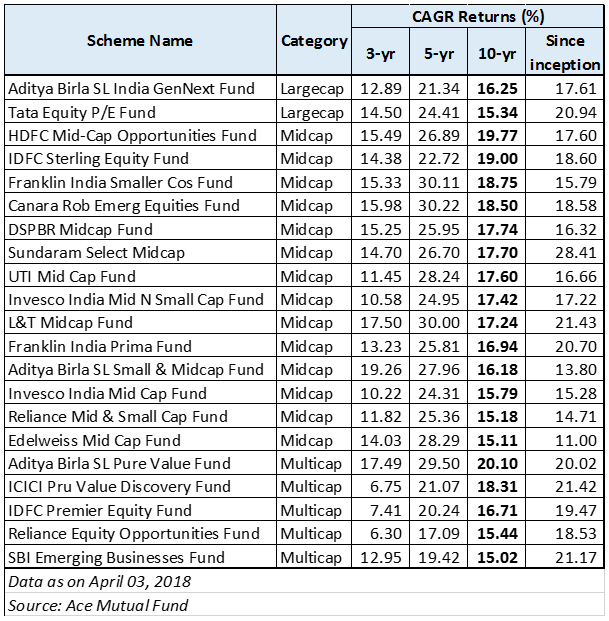

The Act prescribes significant penalties for offenders (see Table). Furthermore, all entities and their agents involved in promoting, marketing, or selling securities must be registered or licensed with the TTSEC, unless specifically exempted.

The Case of Trillions Systems Ltd

The most recent scandal attracting widespread attention is the cryptocurrency and foreign exchange investment scheme operated by Trillions Systems Ltd (“Trillions”).

According to media reports, Trillions was established in mid-2022 and has since attracted over 3,000 investors who collectively contributed millions of dollars. Many complain they have not received either their initial investment or the promised returns.

It was recently revealed that the TTSEC has launched an investigation into the scheme. However, given that public information about Trillions has circulated for months, the TTSEC’s delayed action raises concern. Equally troubling is the fact that Kerron Rose, the principal figure behind Trillions, has openly expressed contempt for both the laws of T&T and the TTSEC’s authority in media reports.

Critical Questions for the TTSEC

This situation prompts several important questions:

- Why did the TTSEC take so long to intervene?

- Was the Trillions scheme ever registered with the TTSEC?

- Is Mr Rose or his company licensed to sell or manage securities?

- Does the product offered by Trillions meet the legal criteria of a prohibited scheme?

- Has the TTSEC issued a cease-and-desist order to halt further promotion of this investment scheme pending investigation?

- What redress is available to investors if it is determined that the TTSEC failed to take timely enforcement action?

Combating Investment Scams

Given the growing prevalence of Ponzi and pyramid schemes, a multi-layered response is required.

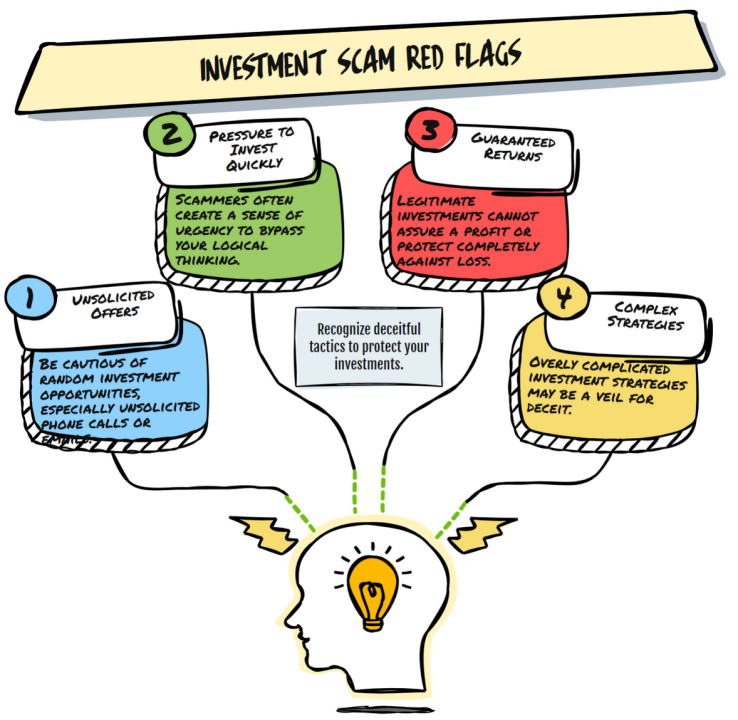

The first line of defence is personal responsibility. Investors must take time to inform themselves about the nature and risks of any investment.

Key guidelines for prospective investors include:

- Be sceptical. If high returns are promised with little or no risk, be extremely cautious. For example, any scheme that promises to double your money in a short period without disclosing the underlying risks is highly likely to be fraudulent.

- Be wary of unsolicited offers. Cold calls, chance encounters in public places, or online promotions should raise immediate suspicion.

- Check the seller. Verify whether the company or individual offering the investment is reputable and licensed by the TTSEC.

- Verify the product. All investment products must be registered with the TTSEC unless an exemption applies.

- Understand the investment. Never commit funds to an opportunity you do not fully understand.

- Report wrongdoing. If you suspect fraud or a scam, report it directly to the TTSEC.

The Role of the TTSEC

The Securities Act of 2012 and its amendments place ultimate responsibility on the TTSEC to:

- ensure the proper functioning of fair and efficient securities markets,

- protect investors from devastating losses caused by prohibited schemes, and

- proactively monitor, identify, and enforce against fraudulent activities.

Additionally, the TTSEC has a duty to promote public education initiatives to help citizens make sound investment decisions and recognise potential scams.

Failure by the TTSEC to take robust enforcement action against prohibited schemes undermines public trust, places investors at severe risk, and could erode confidence in the wider securities market. In such a case, aggrieved investors may demand accountability and redress from the TTSEC itself.

Conclusion

The TTSEC is the final bastion in the fight against investment scams in Trinidad and Tobago. It must act decisively to fulfil its mandate: to protect investors, preserve confidence in financial markets, and ensure that fraudulent schemes such as Ponzi and pyramid operations are swiftly eradicated.